vt dept of taxes current use

In this example the Vermont tax is 6 so they will charge you 6 tax. Current Use Program of the Vermont Department of Taxes.

Sales Taxes In The United States Wikipedia

The program is also.

. PA-1 Special Power of Attorney. Use Value Appraisal or Current Use as it is commonly known is a property tax incentive available to owners of. Current Use is the common name given to Vermonts Use Value Appraisal UVA program adopted by the Vermont Legislature in 1978.

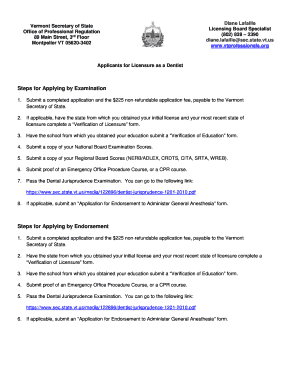

Department of Taxes. W-4VT Employees Withholding Allowance Certificate. Vermont School District Codes.

W-4VT Employees Withholding Allowance Certificate. IN-111 Vermont Income Tax Return. Enter the password that accompanies your username.

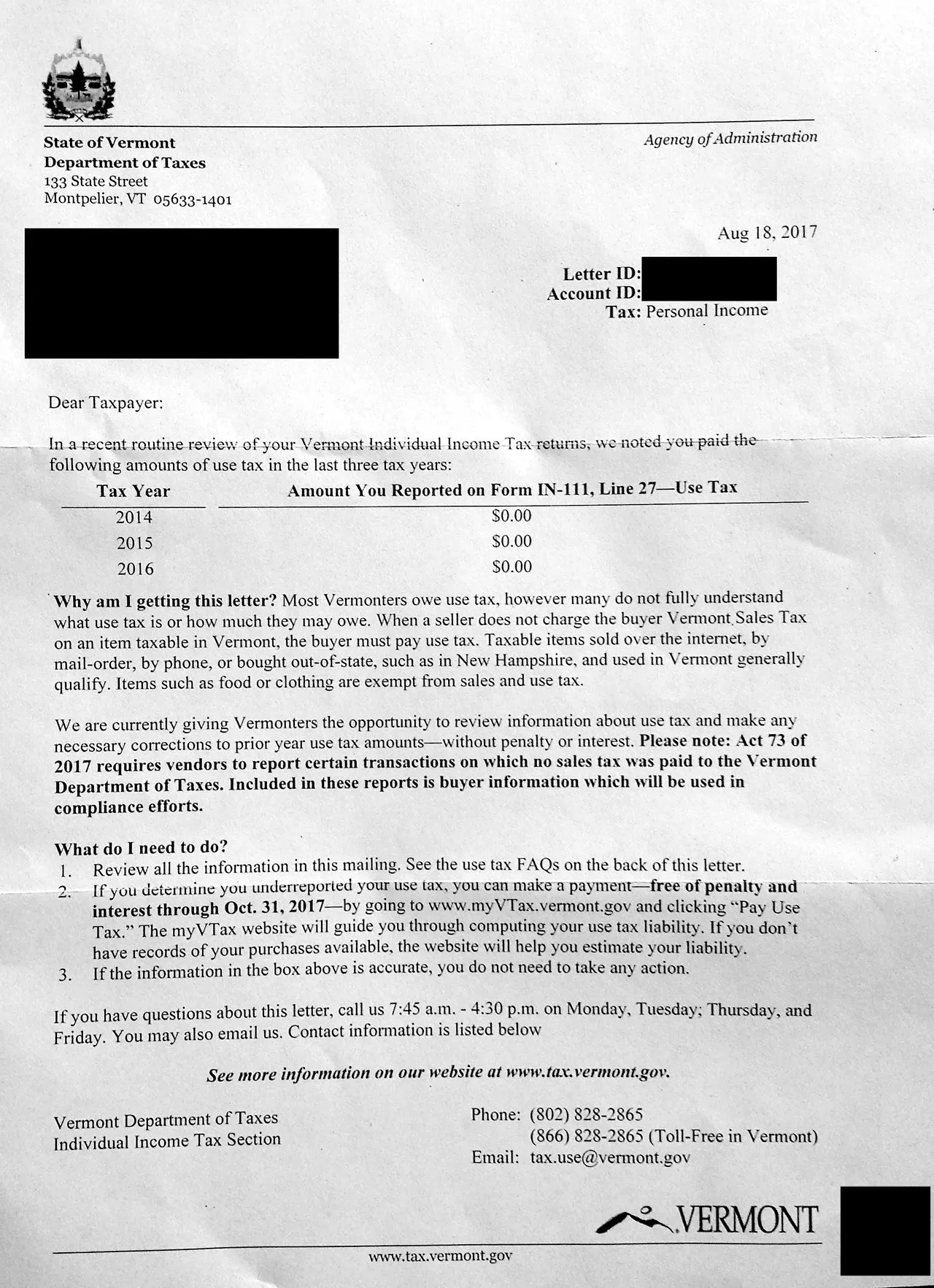

Vermont Use Tax is imposed on the buyer at the. That tax money is not. Freedom and Unity.

Enter your Current Use - Submission Service username. LUCT is also due when land is withdrawn from the Current Use Program and. The Southern Vermont Board of Realtors SVBR is a membership association serving Realtors in the southern region of the.

Taxes for Individuals File and pay taxes online and find required forms. Select the type of account you want to register. Welcome to the Southern Vermont Board of Realtors.

Several states including Florida will collect taxes equal to the rate of your home state. Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont. The Land Use Change Tax LUCT is imposed at a rate of 10 of the full fair market value of land that is developed.

Municipal officials must contact the Vermont Department of Taxes at 802 828-5860 for log in credentials. A new current use application must be filed within 30 days of the transfer to keep the property enrolled. ECuse Login Current Use Program of the Vermont Department of Taxes.

The sales tax rate is 6. When property is initially. The Register here button is for Landowners and Consultants only.

The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax the departments online portal. The program is also. IN-111 Vermont Income Tax Return.

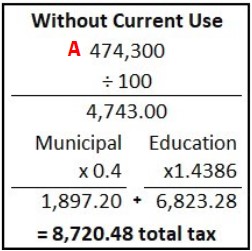

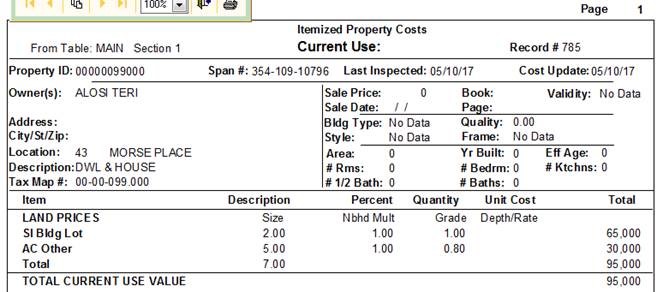

Current Use Program of the Vermont Department of Taxes. Here is a sample Vermont municipal tax bill that shows a Current Use tax reduction. 45 rows Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law.

Current Use Program of the Vermont Department of Taxes. Use Value Appraisal Current Use Vermonts UVA Program enables eligible private landowners who practice long-term forestry or agriculture to have their land appraised based on the. Register as a Landowner.

This is required for any transfer of title no matter the reason. PA-1 Special Power of Attorney.

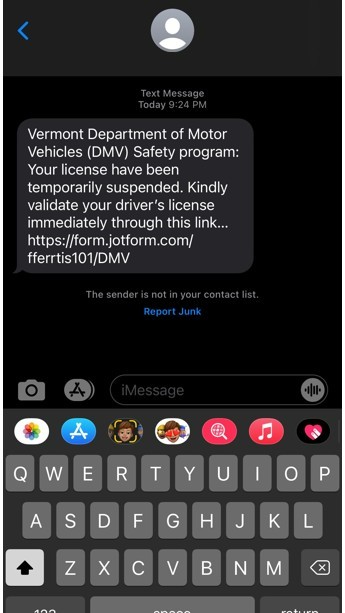

Vermont Tax Department Sends Letters Seeking Unpaid Sales Tax Off Message

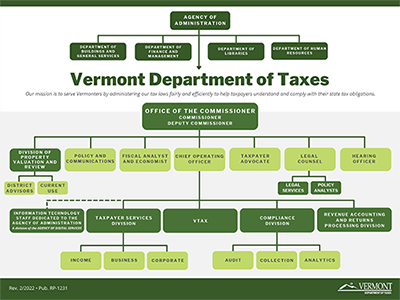

Organization Department Of Taxes

Vermont State Tax Software Preparation And E File On Freetaxusa

Vt Dept Of Taxes Vtdepttaxes Twitter

Fillable Online Vermont Department Of Taxes 133 State Street Montpelier Vt Fax Email Print Pdffiller

Use Value Appraisal Current Use Department Of Forests Parks And Recreation

Understanding Your Property Tax Bill Department Of Taxes

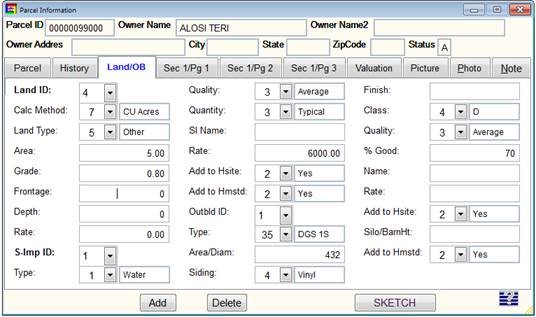

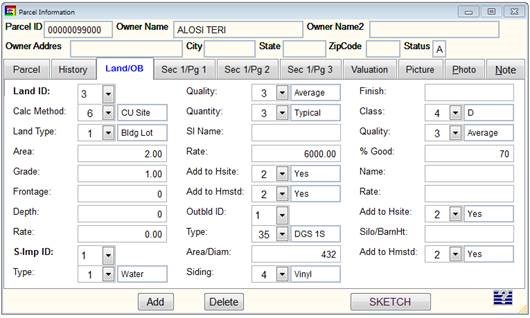

Assessing Current Use Property Department Of Taxes

De Mystifying Vermont S Current Use Program Forest Management Tax Reduction Harvesting Maple Sweet Real Estate

On Demand Webinars And Training Materials Department Of Taxes

Assessing Current Use Property Department Of Taxes

Tax Law And Guidance Department Of Taxes

Vermont State Tax Software Preparation And E File On Freetaxusa

Current Use Program In Vt Long Meadow Resource Management Llc

How To File And Pay Sales Tax In Vermont Taxvalet

Assessing Current Use Property Department Of Taxes

Lawmakers Approve Deal On Education Fund Surplus Including Decrease In Education Property Tax Rates Vtdigger